BY: JANN SWANSON

Black Knight has good news for potential homebuyers, especially those in the market for their first home. The new edition of the company's Mortgage Monitor says the recent decline in mortgage interest rates has made home affordability the best it has been in 18 months.

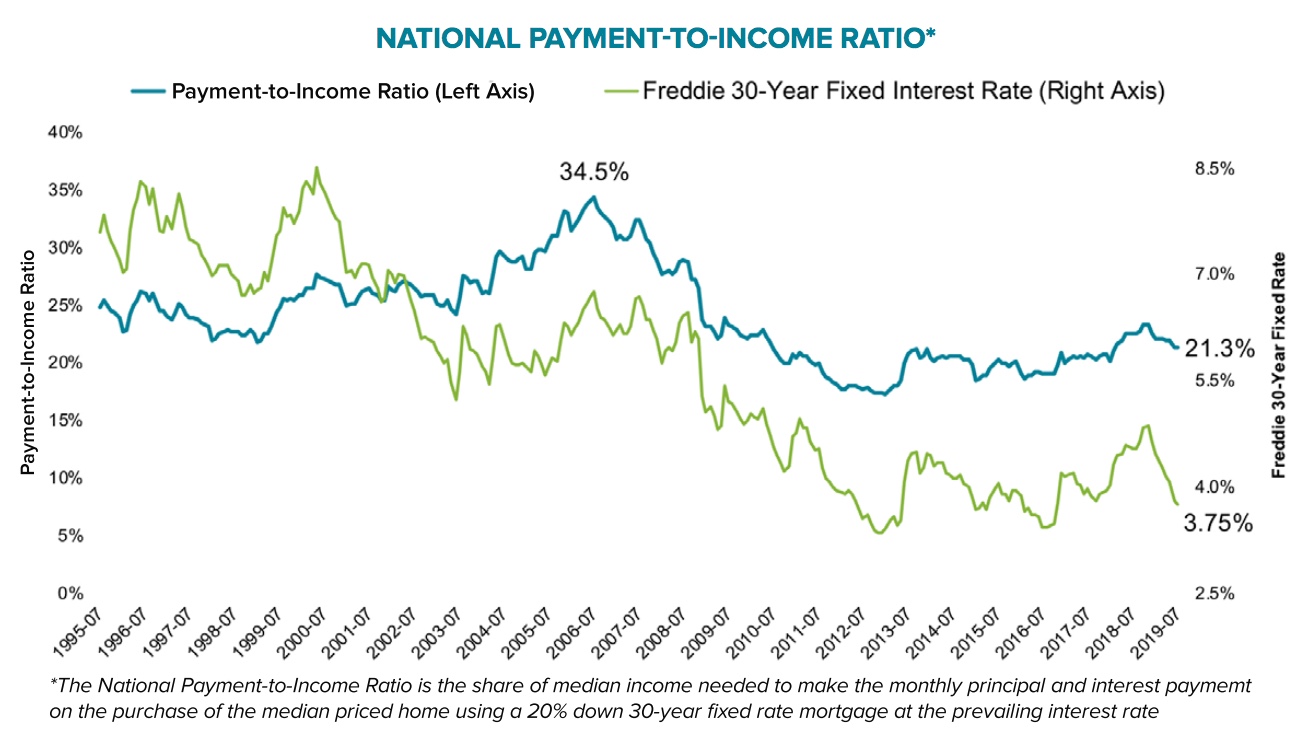

With the 30-year fixed-rate mortgage hovering around 3.75 percent, it now takes 21.3 percent of the nation's median monthly income to make a mortgage payment on the median priced home. This is down from 23.3 percent in November of last year and more affordable than the long-term ratio of around 25 percent that was in-play during a time when the market was generally considered to be "normal," 1995 to 2003. It is also much lower than the 34.5 percent ratio at the height of the housing boom.

The rising payment-to-income ratio, as it hit its recent peak last November, appeared to trigger a strong reaction in both sales and home prices. Given its relatively modest historical position, Black Knight suggests there may be heightened sensitivity to affordability concerns in today's market. Both existing and new home sales have been ragged since then and, although home prices continued to rise, that rate at which they did so slowed considerably.

The average home price has gone up by more than $12 thousand since interest rates peaked last November, but the monthly payment has declined by $108 for an average home purchased with a 20 percent down payment. Black Knight says this is the equivalent of a 15 percent increase in buying power and means a homebuyer could pay $45,000 more for a home without seeing an increase in the monthly payment.

Of course, with lower rates and higher affordability, demand is growing again. The company notes that, the 15-month pattern of price deceleration it had been tracking seems to have leveled off. The annual home price appreciation rate held steady in June at 3.78 percent.

Black Knight cautions that it takes time for impacts for interest rate changes to show up in housing market numbers; even after homebuyers react, there is a time lag due to contract, offer, closing, and recording times. Therefore, the flat appreciation rate from May to June could be just the beginning and the 3.75 interest rate that hit at the end of June may not show up in home sale and price changes until August or September.

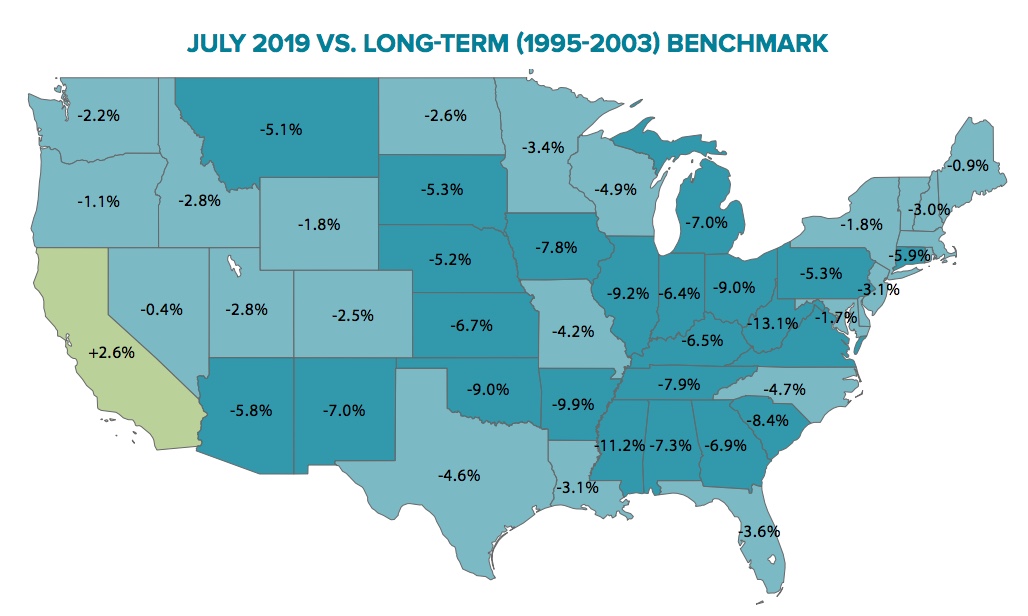

There is a large spread of payment to income ratios across the states, but affordability is improving. Where nine states were less affordable than their long-term norms back in November, only California and Hawaii remained so as of July.

Housing is least affordable along the western U.S. and parts of the northeast, while the Midwest and parts of the South are home to some of the lowest payment-to-income ratios. Not only is housing in the Midwest the most affordable, but it is also the furthest below its own long-term average, as income growth there has been more in line with home price growth than in other areas.

Even in California, however, affordability has improved. The state went from having one of the top five home price growth rates of any state (8.6 percent) one year ago to second-to-last as of June 2019, with home price growth slowing to just 1.3 percent year-over-year. The payment ratio in the state is now 34 percent, down 4 percentage point from November. That is, however, 2.5 points above its long-term ratio. Growth declines in several of the West Coast's largest markets has been significant up; prices in the last 12 months have increased by 1.1 percent or less in Los Angeles, San Francisco, San Diego and Seattle.

Price growth among condominiums have been experiencing greater slowing over the last 12 months than have prices of single-family homes. Up until then the two sets of prices had been rising in lockstep, but now condos are appreciating at 2.2 percent compared to single-family homes at 3.9 percent. That is a 40 percent differential. The company points out that condo prices are historically more volatile, they had a faster appreciation rate in the late 1990s and early 2000s, experienced a sharper downturn during the financial crisis and then recovered faster in 2012 to 2014. Now the tide may be turning again. The company said this could be due to a number of factors and it worth keeping an eye on.

Black Knight also provided an update on the prepayment rate which had been seeing some dramatic increases as rates declined. That, however, ended in June as activity fell by 7.5 percent. It was the first monthly decline since January and the company calls it surprising "given that refinance incentive continues to rise, and home sale driven prepayments typically increase from May to June."

The declines were evident across servicing portfolios, investor classes, interest type and vintages but the strongest reductions were among portfolio held loans, high credit score mortgages and loans originated last year. Those were the cohorts that had seen the largest increase in prepayments previous to June. Black Knight says the pullback may be due to sluggish refi-driven prepayments in June rather than (or potentially in combination with) lackluster home sale driven prepays